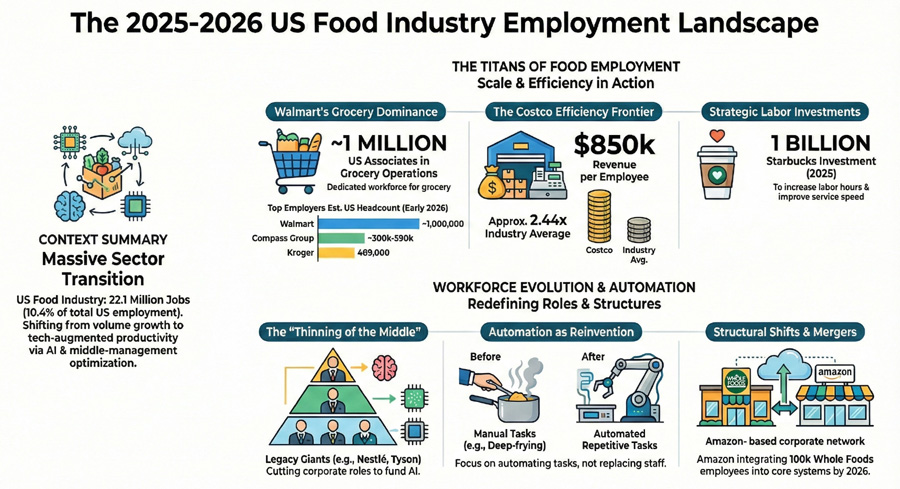

Collectively, the food industry represents one of the largest private employer block in the U.S. when grocery retail, foodservice, and food manufacturing are considered together. While employment is widely distributed across thousands of companies, labor scale is highly concentrated among a relatively small number of operators that anchor food production, distribution, and retail access nationwide.

This ‘TOP 10’ list identifies the largest U.S.-based food industry employers to show where labor remains structurally indispensable in the food system. Grocery retail and contract foodservice account for the largest concentrations of frontline labor, while food manufacturing and full-service dining play more specialized—but still critical—roles. While the list is dedicated to outlining the top 10 food industry employers it’s critical to note that small independent food businesses—roughly 484,000 independent restaurants (about 70% of all U.S. restaurants) plus tens of thousands of independent grocers and small food‑manufacturing firms—collectively employ on the order of 10–11 million people, or around 60% of the roughly 17.5 million workers in the combined restaurant, grocery, and food‑manufacturing sectors. Independent restaurants alone likely account for 8–9 million jobs and independent grocers directly support about 1.1 million jobs, making these local operators a major source of entry‑level work, part‑time jobs, and community‑anchored employment alongside the large corporate chains outlined below.

Finally, as automation and productivity initiatives accelerate, absolute headcount alone is no longer a proxy for influence. But understanding where large workforces still exist provides insight into operational complexity, cost structure, and which segments of the food system remain labor-intensive and difficult to automate.

1. Walmart

Sector: Grocery & Mass Retail

Estimated U.S. Workforce: ~1.6 million (all roles)

Walmart is the dominant employer in the U.S. food system by scale. While the company does not separately disclose grocery-specific labor, food represents a majority of U.S. store traffic and sales. Walmart’s grocery operations span supercenters, Neighborhood Markets, and online fulfillment, making it the single most structurally important labor platform in food retail.

2. Kroger

Sector: Supermarket Retail

U.S. Workforce: ~400,000+

Kroger is the largest pure-play grocery employer in the United States. In addition to operating thousands of supermarkets, Kroger runs one of the most vertically integrated food retail models in the country, including company-owned food manufacturing plants that support fresh departments and private label programs.

3. Starbucks

Sector: Foodservice (Quick Service)

Estimated U.S. Workforce: ~300,000

Starbucks is one of the largest direct employers in U.S. foodservice due to its predominantly company-operated store model. Unlike franchise-heavy peers, most U.S. locations are staffed by employees on the corporate payroll, resulting in unusually high reported headcount for the category.

4. Compass Group North America

Sector: Contract Foodservice

Estimated U.S. Workforce: ~300,000

Compass Group North America is the largest contract foodservice operator in the United States, serving education, healthcare, corporate, and institutional clients. Employment levels fluctuate with contract volume but consistently rank among the largest in domestic foodservice.

5. Publix Super Markets

Sector: Supermarket Retail

U.S. Workforce: ~250,000+

Publix is the largest employee-owned grocery chain in the U.S., with operations concentrated in the Southeast. Its ESOP-based ownership structure and internal promotion model support a large and relatively stable workforce.

6. Albertsons Companies

Sector: Supermarket Retail

U.S. Workforce: ~250,000

Albertsons operates a national portfolio of supermarket banners across multiple regions. While its workforce has remained relatively stable, the company has played a central role in recent industry consolidation discussions, underscoring its importance to food retail labor dynamics.

7. Costco Wholesale

Sector: Warehouse Grocery

U.S. Workforce: ~200,000+

Costco operates a high-productivity labor model built around limited assortment, high sales volume, and above-average wages. Although it operates fewer locations than conventional grocers, its U.S. workforce remains one of the largest in food retail.

8. Darden Restaurants

Sector: Full-Service Dining

U.S. Workforce: ~190,000+

Darden is the largest employer in the U.S. full-service restaurant segment. Its workforce supports a diversified portfolio of casual and upscale dining brands, giving the company a uniquely large labor footprint within restaurant foodservice.

9. Aramark

Sector: Contract Foodservice

U.S. Workforce: ~140,000+

Aramark is a major employer across education, healthcare, sports, and business dining. Like other contract foodservice operators, its workforce size reflects active contract volume rather than owned locations.

10. Tyson Foods

Sector: Protein Manufacturing

Global Workforce: ~130,000

U.S. Share: Majority

Tyson Foods is the largest protein manufacturing employer in the U.S. food system. While employment levels fluctuate with livestock cycles and plant optimization, Tyson remains a cornerstone employer in meat and poultry processing.

Important Notes & Methodology for the 2025-2026 list

-

Scope and Ranking Basis

Rankings reflect estimated U.S.-based food-related employment, including company-operated grocery retail, foodservice, and food manufacturing labor. This list is intended as a structural reference, not a labor audit, wage analysis, or workforce forecast. -

Franchise vs. Corporate Labor

Only employees on a company’s direct payroll are included. Franchise employees are excluded, which materially affects restaurant rankings. In foodservice, total systemwide employment is often 5–10× larger than corporate headcount. For example, while McDonald’s corporate payroll is roughly 150,000, independent franchisees employ more than 2 million people. Grocers such as Kroger, by contrast, employ most workers directly. -

Estimates and Rounding

Many companies do not disclose precise U.S. headcounts. Figures are therefore rounded estimates, based on public filings, earnings commentary, and widely cited industry sources. -

Food Manufacturing Representation

Food manufacturing employers are comparatively underrepresented due to higher automation levels and fewer frontline roles relative to grocery retail and foodservice. - Industry Structure and Recent Developments

-

The proposed Kroger–Albertsons merger was officially terminated in January 2026 following successful legal challenges by the FTC and state attorneys general. Had it closed, the combined entity would have employed nearly 700,000 workers, rivaling Amazon’s grocery footprint.

-

Amazon is in the process of integrating the Whole Foods workforce into its core corporate systems. By late 2026, approximately 100,000 employees are expected to transition to Amazon’s internal platforms for benefits, pay, and performance management, effectively ending Whole Foods’ status as a separate employment entity.

-

- Automation Context

While research suggests a significant share of foodservice tasks could be automated, the industry’s current focus is on operational reinvention rather than workforce replacement. Automation is primarily applied to repetitive or hazardous tasks (e.g., palletizing, frying), enabling human labor to remain concentrated in customer-facing and skilled roles amid persistent labor constraints.