Key Takeaways

- Utilization is King: Plants at 85%+ utilization drive profit; those below 70% typically destroy value regardless of size.

- SKU Discipline: Rationalizing your portfolio can improve throughput by 15-25%.

- The Stability Premium: Stable demand patterns often deliver higher margins than high-volume promotional spikes.

- Fixed Cost Reality: 40-60% of manufacturing expenses are fixed, making capacity planning precision vital.

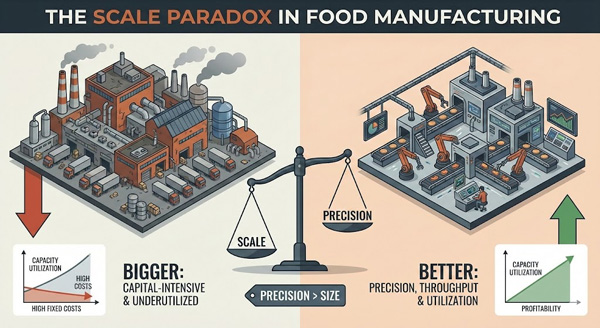

The food manufacturing industry operates on a fundamental misconception. Growth targets dominate boardroom conversations, yet operational reality tells a different story: scale advantages emerge from precision, not size. Bigger factories do not automatically produce better economics. In food manufacturing, scale is earned through utilization, throughput discipline, and demand stability—not square footage or brand size.

The Three Pillars of Manufacturing Scale

Food manufacturing scale works only when three specific conditions align:

| Scale Driver | What Actually Matters |

|---|---|

| Capacity | Consistently high utilization (85%+ target) |

| Complexity | Tight SKU discipline and portfolio restraint |

| Demand | Stable, predictable volume patterns |

Miss one of these three pillars, and size becomes a liability rather than an advantage.

Fixed Costs: The Hidden Weight of Food Production

Food production facilities carry substantial structural overhead. Equipment depreciation, regulatory compliance infrastructure, quality assurance systems, and base labor requirements remain constant whether a line runs eight hours or twenty-four. Manufacturing economics follow counterintuitive patterns: Industry benchmarks reveal fixed costs typically represent 40 to 60 percent of total expenses.

Food production facilities carry substantial structural overhead. Equipment depreciation, regulatory compliance infrastructure, quality assurance systems, and base labor requirements remain constant whether a line runs eight hours or twenty-four. Manufacturing economics follow counterintuitive patterns: Industry benchmarks reveal fixed costs typically represent 40 to 60 percent of total expenses.

Profitability Inflection Points:

- Plants operating below 70% capacity utilization frequently fail to achieve positive margins.

- Facilities maintaining 85% utilization or higher generate significant returns on the same asset base.

- A $50 million plant running half-empty destroys value; the same facility near capacity becomes a profit engine.

Throughput Intensity Beats Physical Scale

Scale is about how much product moves through each line, each hour. Operational efficiency metrics prioritize output intensity over physical infrastructure. High-performing plants optimize four critical metrics: Line speed, changeover time, production run length, and labor productivity.

Changeover time illustrates this with stark clarity. High-speed packaging lines can process 600 units per minute; a 30-minute changeover equals 18,000 lost units. Elite manufacturers achieve changeover times 40 to 60 percent faster through deliberate process engineering.

The SKU Proliferation Trap

Marketing-driven expansion introduces hidden costs: frequent changeovers, shorter runs, and deteriorating forecast accuracy. Supply chain analytics firms document that SKU rationalization typically improves throughput 15 to 25 percent while reducing working capital requirements. Portfolio discipline is a scale enabler, not a growth constraint.

Demand Stability: The Overlooked Scale Driver

Stable, predictable order streams allow planning optimization. Conversely, promotional volatility forces overtime labor and suboptimal batch sizes. The cost of volatile high-volume production often exceeds stable moderate-volume operations. This is why contract manufacturers insist on minimum volume commitments and price volatile patterns at substantial premiums.

Procurement and Automation

While scale delivers procurement benefits like payment term negotiation, raw material savings are often captured by retailers. Furthermore, capital-intensive automation only delivers returns after establishing volume certainty. Successful automation follows a sequence: Validate demand, rationalize SKUs, standardize processes, and then automate against known parameters.

Regulatory Compliance and Co-Manufacturing

Small producers face asymmetric burdens. Initial FSMA compliance costs for small businesses hit $20,000–$22,000, with $8,000 in annual costs. To bridge this, many brands use contract manufacturing, an industry projected to reach $102.8 billion by 2031.