The QSR 50 is an annual ranking of limited-service restaurant companies published by QSR Magazine. The 2025 QSR 50 report highlights the current state and future trends of the fast-food industry. Below are some key insights from report and also a table outlining the Top 50 and how they fared in 2024:

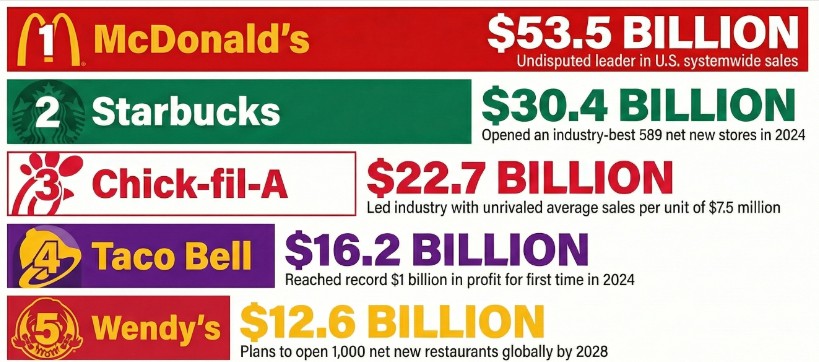

Notes about the Top 5 Performers

1. McDONALD’S

McDonald’s retained the top rank with $53.5 billion in U.S. systemwide sales, relying on value strategies and organizational changes, despite facing a sales dip tied to an E. coli outbreak

- The company used its successful $5 Meal Deal as a cornerstone of the McValue platform to counteract consumer pullback, especially from lower-income guests

- An E. coli outbreak linked to slivered onions in Q4 2024 resulted in a 1.4 percent drop in U.S. same-store sales, leading McDonald’s to invest $100 million into a recovery initiative

- To accelerate innovation, McDonald’s restructured, forming a new Restaurant Experience Team and creating category leaders for beef, chicken, and beverages to better compete against specialty chains

- Innovation efforts include testing crafted beverages from its spinoff concept CosMC’s inside existing stores and planning the return of Snack Wraps and the introduction of chicken strips later in the year

- The chain added 102 net restaurants in 2024, marking the largest increase in unit growth in a single year since 2013

2. STARBUCKS

Starbucks achieved the highest unit growth across the industry in 2024 and implemented the “Back to Starbucks” strategy focused on emphasizing customer connection and improving speed of service through operational and labor investments

- Starbucks opened an industry-best 589 net stores in 2024, growing its U.S. footprint to 16,935 units and quickly approaching Subway as the largest U.S. restaurant chain

- CEO Brian Niccol’s “Back to Starbucks” plan includes in-store design refreshes to restore the “third place” atmosphere, bringing back the condiment bar, and having baristas write messages on cups

- The brand expanded a 700-unit pilot focusing on staffing and deployment, which led to a sizable improvement in transactions and speed, with average wait times decreasing by two minutes

- The theme for the brand is shifting focus from beverage production via equipment (like the “Siren” package) to “craft and connection,” supported by menu simplification (trimming by 30 percent)

3. CHICK-FIL-A

Chick-fil-A continued to generate unrivaled sales volumes at scale in 2024, posting the highest average unit volume in the QSR 50 and accelerating its plans for international expansion

- The brand led the list with an unrivaled blended Average Unit Volume (AUV) of $7.5 million

- Chick-fil-A grew its total unit count by 145 restaurants and reached $22.7 billion in systemwide sales

- The brand announced ambitious international expansion plans, including a $100 million plan for the U.K. and a $75 million plan for Asia

- The Asia development effort is scheduled to begin with openings in Singapore in late 2025

4. TACO BELL

Taco Bell achieved a record $1 billion in profit in 2024 and detailed an aggressive “R.I.N.G. The Bell” strategy aimed at expanding its footprint, doubling menu innovation, and driving AUV and digital sales dramatically higher by 2030

- The chain reached a record $1 billion in profit for the first time in 2024, reporting over 24 percent restaurant-level margins and contributing 80 percent of Yum! Brands’ U.S. profit

- Taco Bell introduced the “R.I.N.G. The Bell” growth plan, targeting an increase in AUV from $2.2 million to $3 million and profit to $2 billion by 2030

- Digital sales, which were 35 percent of the mix in 2024, are projected to surpass 60 percent by 2030, contributing an estimated $225,000 in incremental AUV

- The chain sees a path to reaching 10,000 U.S. restaurants (up from 7,604) by leveraging nontraditional asset types

- Loyalty members are significantly more engaged, increasing their visits by 76 percent (from 5.8 to 10.2 visits per year) after joining the program

5. WENDY’S

Wendy’s is executing a disciplined growth strategy focused on targeted global expansion, operational modernizations through the Global Next Gen design, and focused marketing to attract high-frequency QSR super fans

- The company plans to open 1,000 net new restaurants globally by 2028, with 300 locations targeted for the U.S., using the energy-efficient and digital-first Global Next Gen design

- The brand is focused on replacing underperforming markets with high-potential restaurants, resulting in the net shuttering of 97 U.S. locations in 2024

- Wendy’s aims to capture more visits from their “super fans”—customers who visit fast food nearly 130 times annually—by optimizing marketing for target audiences like Gen Z and multicultural guests

- Menu innovation includes expanding the Frosty lineup and investing in its core chicken platform, as well as boosting beverage options like craft lemonades and morning drinks

- The company expects to reach $17.5 billion to $18 billion in global system sales by 2028

THE TOP 50 FAST FOOD (QSR) CHAINS*

| RANK | COMPANY | 2024 U.S. SYSTEMWIDE SALES (MILLIONS) | 2024 AVERAGE SALES PER UNIT (THOUSANDS) | 2024 FRANCHISE/LICENSE UNITS | 2024 COMPANY UNITS | 2024 TOTAL UNITS | TOTAL CHANGE IN UNITS FROM 2023 |

|---|---|---|---|---|---|---|---|

| 1 | McDONALD’S | $53,469 | $4,002 | 12,887 | 672 | 13,559 | 102 |

| 2 | STARBUCKS | $30,400 | $1,800 | 6,777 | 10,158 | 16,935 | 589 |

| 3 | CHICK-FIL-A | $22,746 | $7,500 | 3,054 | 55 | 3,109 | 145 |

| 4 | TACO BELL | $16,200 | $2,130 | 7,106 | 498 | 7,604 | 199 |

| 5 | WENDY’S | $12,554 | $2,098 | 5,552 | 381 | 5,933 | -97 |

| 6 | DUNKIN’ | $12,468 | $1,300 | 9,734 | 34 | 9,768 | 188 |

| 7 | CHIPOTLE | $11,111 | $3,213 | 0 | 3,644 | 3,644 | 273 |

| 8 | BURGER KING | $10,980 | $1,639 | 5,524 | 1,177 | 6,701 | -77 |

| 9 | SUBWAY | $9,653 | $495 | 19,502 | 0 | 19,502 | -631 |

| 10 | DOMINO’S | $9,500 | $1,354 | 6,722 | 292 | 7,014 | 160 |

| 11 | PANDA EXPRESS | $6,199 | $2,592 | 175 | 2,330 | 2,505 | 85 |

| 12 | PANERA | $5,819 | $2,626 | 1,105 | 1,101 | 2,206 | 35 |

| 13 | POPEYES | $5,726 | $1,819 | 3,050 | 98 | 3,148 | 97 |

| 14 | PIZZA HUT | $5,500 | $839 | 6,534 | 23 | 6,557 | -36 |

| 15 | SONIC DRIVE-IN | $5,384 | $1,500 | 3,144 | 317 | 3,461 | -60 |

| 16 | RAISING CANE’S | $4,960 | $6,560 | 22 | 806 | 828 | 101 |

| 17 | DAIRY QUEEN | $4,909 | $1,165 | 4,210 | 2 | 4,212 | -42 |

| 18 | KFC | $4,900 | $1,336 | 3,589 | 80 | 3,669 | -122 |

| 19 | WINGSTOP | $4,765 | $2,138 | 2,154 | 50 | 2,204 | 278 |

| 20 | JACK IN THE BOX | $4,396 | $2,007 | 2,037 | 150 | 2,187 | 3 |

| 21 | ARBY’S | $4,325 | $1,300 | 2,286 | 1,079 | 3,365 | -48 |

| 22 | WHATABURGER | $4,257 | $4,026 | 206 | 879 | 1,085 | 88 |

| 23 | PAPA JOHNS | $3,808 | $1,157 | 2,752 | 539 | 3,291 | 71 |

| 24 | JERSEY MIKE’S | $3,731 | $1,325 | 2,970 | 27 | 2,997 | 313 |

| 25 | CULVER’S | $3,680 | $3,691 | 990 | 7 | 997 | 52 |

| 26 | LITTLE CAESARS | $3,500 | $900 | 3,705 | 580 | 4,285 | 69 |

| 27 | ZAXBYS | $2,630 | $2,790 | 825 | 143 | 968 | 26 |

| 28 | JIMMY JOHN’S | $2,599 | $977 | 2,647 | 42 | 2,689 | 45 |

| 29 | FIVE GUYS | $2,270 | $1,536 | 875 | 613 | 1,488 | 35 |

| 30 | IN-N-OUT BURGER | $2,175 | $5,240 | 0 | 415 | 415 | 15 |

| 31 | BOJANGLES | $1,881 | $2,351 | 559 | 266 | 825 | 12 |

| 32 | HARDEE’S | $1,830 | $1,146 | 1,393 | 204 | 1,597 | -110 |

| 33 | DUTCH BROS | $1,819 | $2,018 | 312 | 670 | 982 | 151 |

| 34 | CARL’S JR. | $1,520 | $1,430 | 1,014 | 49 | 1,063 | -5 |

| 35 | CRUMBL | $1,435 | $1,355 | 1,058 | 1 | 1,059 | 87 |

| 36 | TROPICAL SMOOTHIE CAFE | $1,420 | $1,005 | 1,514 | 1 | 1,515 | 143 |

| 37 | SHAKE SHACK | $1,351 | $3,900 | 44 | 329 | 373 | 39 |

| 38 | QDOBA | $1,200 | $1,695 | 613 | 164 | 777 | 30 |

| 39 | FIREHOUSE SUBS | $1,153 | $973 | 1,191 | 42 | 1,233 | 38 |

| 40 | EL POLLO LOCO | $1,096 | $2,300 | 173 | 325 | 498 | 3 |

| 41 | MARCO’S PIZZA | $1,051 | $932 | 1,117 | 45 | 1,162 | 46 |

| 42 | McALISTER’S | $1,018 | $1,891 | 524 | 36 | 560 | 21 |

| 43 | FREDDY’S | $988 | $1,900 | 515 | 35 | 550 | 35 |

| 44 | DEL TACO | $957 | $1,611 | 461 | 133 | 594 | 2 |

| 45 | CAVA | $954 | $2,900 | 0 | 367 | 367 | 58 |

| 46 | CHECKERS/RALLY’S | $853 | $1,171 | 532 | 229 | 761 | -26 |

| 47 | CHURCH’S CHICKEN | $847 | $1,097 | 602 | 159 | 761 | -28 |

| 48 | KRISPY KRUNCHY CHICKEN | $800 | $300 | 3,168 | 0 | 3,168 | 325 |

| 49 | AUNTIE ANNE’S | $786 | $763 | 1,210 | 11 | 1,221 | 23 |

| 50 | TIM HORTONS | $776 | $1,188 | 630 | 23 | 653 | 22 |