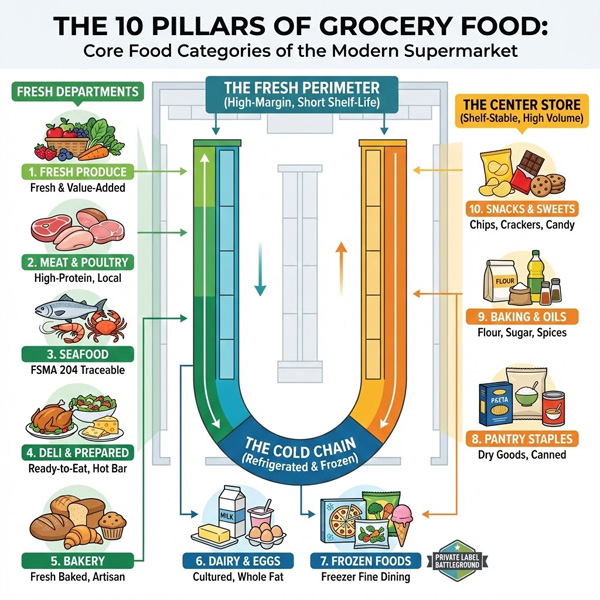

Whether it’s a corner grocery store, a traditional supermarket or the food section of a large hypermarket, the typical store operates as an engineered system optimized for visit frequency, basket composition, and profitability per square foot. One thing is for sure and that is they don’t arrange themselves by accident. Store layouts represent decades of accumulated knowledge about shopper psychology, supply chain constraints, and retail economics. While individual stores vary by size and format, most conventional supermarkets operate within a consistent structural framework built around three operational zones: the perimeter, center store, and strategic cross-department overlays.

This architecture explains product placement decisions, departmental profitability drivers, and how retailers approach assortment planning, traffic optimization, and margin management.

The Perimeter: Fresh Categories as Traffic Drivers

Fresh, perishable departments anchor the store perimeter. These sections generate repeat visits, command premium pricing, and establish consumer perception of quality.

Produce typically occupies the entry position. Fresh fruits and vegetables function as primary trip generators, reinforcing freshness perception and value positioning. Organic offerings and value-added formats like packaged salads and pre-cut fruit expand margins while serving convenience-focused consumers.

The deli has evolved into what industry analysts call the “grocerant” concept—prepared foods, hot bars, and grab-and-go meals that position grocery stores as direct restaurant competitors. Traditional service deli operations (sliced meats, artisan cheeses) remain foundational, while catering programs and specialty platters capture occasion-based purchasing.

Meat and poultry departments build basket size. Fresh beef, pork, and chicken anchor household meal planning and trigger complementary purchases throughout the store. According to Food Marketing Institute data, meat remains among the highest-spending categories in conventional grocery.

Seafood occupies a smaller footprint but plays an outsized strategic role tied to health trends and premium protein demand. Most retailers split seafood between fresh service cases and frozen self-service sections.

In-store bakeries reinforce freshness cues through visible production. Everyday items like bread and rolls drive impulse purchases, while custom cakes and artisan loaves support higher-margin, event-driven sales.

Dairy and eggs deliver consistent volume along perimeter walls. Traditional dairy merchandising increasingly incorporates plant-based alternatives, reflecting shifting consumer preferences documented in recent Nielsen research.

Center Store: Shelf-Stable Volume and Operational Efficiency

Center store aisles contain shelf-stable and frozen products that support pantry stocking and bulk purchasing. While margins typically run tighter than fresh departments, these categories provide scale and operational predictability.

Frozen food has transformed beyond basic convenience. Premium frozen meals now emphasize quality, global flavors, and restaurant-inspired positioning—a shift some retailers describe as “freezer fine dining.” Frozen produce, snacks, and desserts round out the category.

Grocery aisles (sometimes called “food cupboard” or “dry grocery”) form the center store backbone. Canned goods, pasta, baking ingredients, and condiments represent predictable demand patterns and extended shelf life, making them ideal candidates for broad assortments and private label expansion.

Snacks and candy are impulse-driven categories with high promotional intensity. These products generate frequent, unplanned purchases and dominate endcap displays and seasonal merchandising programs.

Strategic Overlays: How Retailers Actually Manage Assortment

Beyond physical department boundaries, retailers increasingly organize stores through strategic overlays that cut across traditional sections.

Private label spans virtually every category—from basic pantry staples to premium frozen entrées and fresh items. Rather than occupying a dedicated department, store brands function as a strategic layer used to control margin, differentiate the retail banner, and build customer loyalty. Private label growth has accelerated particularly in conventional grocery formats.

Health and wellness operates similarly. High-protein products, functional ingredients, and “free-from” items distribute throughout the store rather than concentrating in a single natural/organic section. This reflects actual shopping behavior and competitive positioning.

Why This Model Persists

The conventional supermarket structure balances three competing operational objectives:

- Traffic generation and quality perception driven by fresh perimeter departments

- Volume throughput and supply chain efficiency supported by center store categories

- Margin control and competitive differentiation enabled by private label and wellness positioning

Store formats continue evolving—smaller footprints, expanded prepared food programs, aggressive private label growth—but the underlying organizational logic remains consistent. It reflects not just consumer purchasing patterns, but fundamental grocery retail economics.