Beef Industry’s Pricing Paradox

Retail beef prices have reached historic highs, yet cattle ranchers continue facing severe margin pressure. The disconnect reveals a critical structural flaw in America’s beef supply chain—a concentration chokepoint that fundamentally alters how value flows through the system.

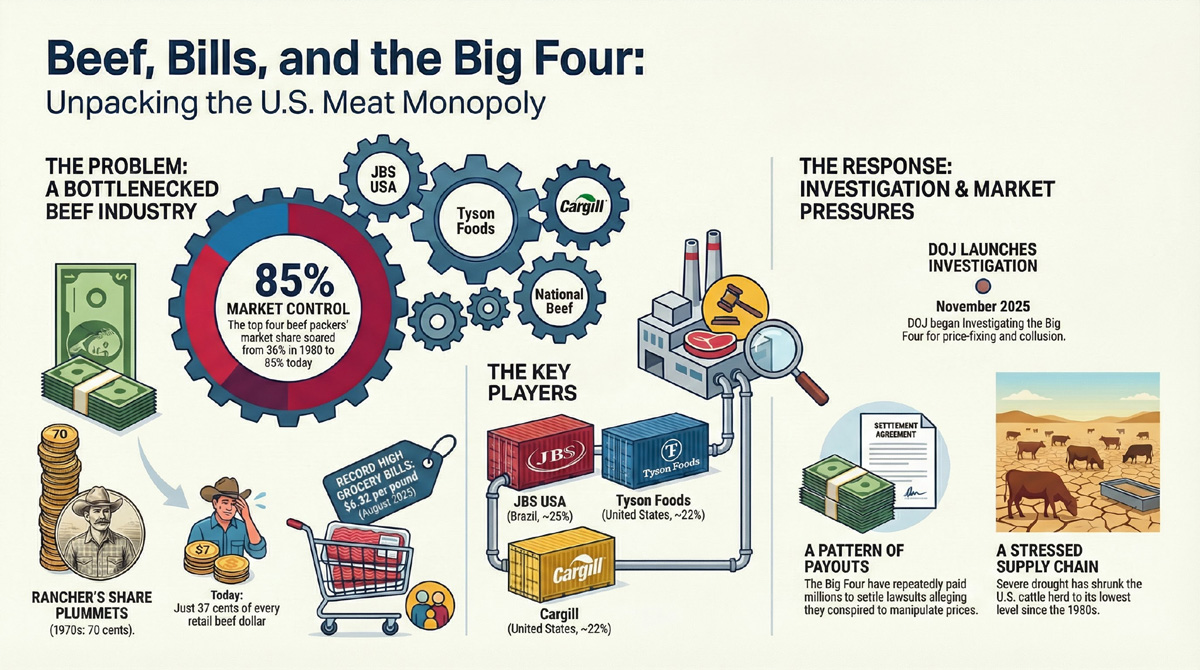

Four companies control roughly 80-85% of fed cattle slaughter in the United States: Tyson Foods, JBS, Cargill, and National Beef. This oligopsony structure—many sellers, few buyers—creates asymmetric negotiating power that ranchers cannot easily navigate around.

Consolidation’s Four-Decade Arc

The transformation happened gradually but relentlessly. In 1980, the top four packers controlled approximately one-third of the market. Through aggressive M&A activity and construction of high-throughput facilities requiring billions in capital investment, that figure exceeded 80% by the mid-1990s. It hasn’t meaningfully changed since.

Scale delivered operational efficiency but erected formidable barriers to entry. Modern beef plants demand extensive capital, complex regulatory compliance, and guaranteed high-volume throughput—conditions that effectively lock out meaningful new competition.

Key Market Dynamics:

- Producer share of consumer beef dollar has declined significantly since the 1970s

- Processing, distribution, and retail margins have expanded proportionally

- Pricing power concentrates at the processing bottleneck rather than distributing across the value chain

- Extreme concentration introduces systemic operational fragility

The vulnerability became evident through discrete disruption events. A 2019 fire at a single Tyson facility temporarily eliminated roughly 6% of national beef processing capacity. The 2021 JBS ransomware attack disrupted a substantial share of U.S. meat production. These incidents exposed the fundamental trade-off: efficiency gains from consolidation versus resilience, redundancy, and food security.

Federal scrutiny has intensified accordingly. The Department of Justice has launched antitrust investigations examining allegations of price coordination, production management, and producer retaliation. Multiple civil lawsuits have been settled without admissions of wrongdoing, but the persistence of regulatory attention signals deep structural concerns beyond individual conduct.

The industry faces a fundamental choice: structural reform through enhanced antitrust enforcement, improved pricing transparency, and regional processing capacity investments—or continuation of the current model where settlements and fines leave underlying market dynamics unchanged. The implications extend beyond beef pricing to rural economic stability, supply chain resilience, and control over critical protein infrastructure.

Check out our infographic: