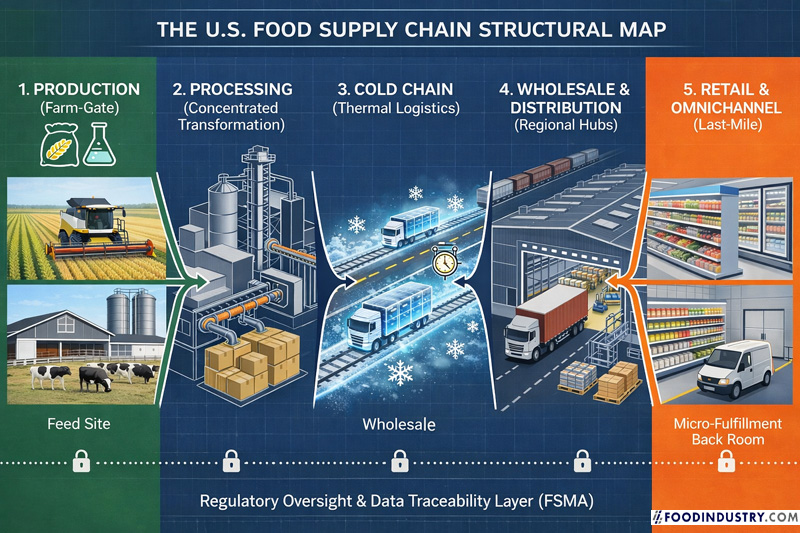

1. Production: The Input Gatekeepers

The supply chain begins at the farm gate, but structural control originates one step earlier with agricultural inputs. This stage is defined by the management of biological and chemical resources required to initiate the production cycle.

Power Dynamics: Control at this level is concentrated among what industry analysts term “Input Giants”—Nutrien, Corteva Agriscience, and Bayer Crop Science—who collectively provide the seeds, fertilizers, and crop protection technologies that determine productivity parameters. These firms control 60-70% of the global pesticides market and 50-60% of the global seed market. In North American fertilizer markets, concentration is even more pronounced, with four firms supplying 75% of nitrogen-based products and just two companies—Nutrien and Mosaic—controlling 100% of potash fertilizer supply.

Structural Role: Agricultural producers operate within fixed biological cycles and geographic constraints dictated by climate zones and soil composition. In livestock production, power dynamics shift toward vertical integration models, where processors provide genetic stock and feed formulations while farmers contribute labor and facility infrastructure under contract arrangements.

Core Functions:

-

- Input management protocols governing seed selection and soil amendment strategies

- Initial storage infrastructure, including on-farm grain silos and climate-controlled facilities that function as temporary buffers before commodities enter the broader logistics network

2. Processing & Manufacturing: The Consolidated Bottleneck

Once raw agricultural materials leave the farm gate, they enter the most consolidated node of the entire supply chain. This transformation stage converts bulk commodities into consumer-ready products through standardized processing protocols.

Power Dynamics: This segment exhibits exceptionally high CR4 ratios (market concentration among the top four firms). In beef processing, four companies—Tyson Foods, JBS USA, Cargill Protein, and National Beef—control approximately 80-85% of total slaughter capacity, a dramatic increase from 36% in 1980. This creates what economists describe as an “hourglass effect,” where thousands of independent producers must channel their output through a handful of processing facilities.

Structural Role: Processing facilities function as the primary compliance filter for the entire food system. Under the Food Safety Modernization Act (FSMA), processors bear responsibility for creating and maintaining traceability lot codes, establishing them as the authoritative data custodians for downstream supply chain visibility. These transformation events represent critical control points where regulatory requirements, food safety protocols, and chain-of-custody documentation converge.

Core Functions:

-

- Physical transformation processes that convert raw ingredients into new product forms (slaughtering, milling, extraction, formulation)

- Packaging operations that ensure shelf stability, regulatory compliance, and consumer information requirements

- Quality assurance systems that validate food safety parameters and establish traceability frameworks

3. The Cold Chain: Infrastructure of Resilience

The cold chain represents a continuous environmental condition rather than a discrete location. It functions as the thermal infrastructure protecting the nation’s perishable food supply, moving meat, dairy, and produce through an unbroken temperature-controlled network from processing facility to point of sale.

Power Dynamics: Control resides in the ownership and operation of specialized capital assets—refrigerated warehouse facilities and temperature-controlled transportation fleets (“reefer” units). These assets require substantial capital investment and sophisticated operational expertise, creating significant barriers to entry.

Structural Role: This infrastructure determines what industry professionals call the “radius of freshness”—the geographic distance perishable products can travel while maintaining quality and safety standards. Without the cold chain, the U.S. food system would remain fundamentally localized rather than operating as an integrated national network. It represents the primary defense mechanism against food waste and microbial spoilage.

Core Functions:

-

- Thermal protection protocols maintaining precise temperature ranges (typically 2°C to 8°C for chilled products; sub-zero for frozen goods)

- Active monitoring systems employing IoT sensors and data loggers to validate thermal integrity throughout transit

- Risk mitigation frameworks addressing equipment failure, power outages, and other disruption scenarios

4. Wholesale & Distribution: The Middle-Mile Aggregators

Foodservice distributors function as the circulatory system of the food industry, bridging the operational gap between thousands of manufacturers and millions of consumer endpoints. This segment operates primarily in the business-to-business space, serving restaurants, hospitals, schools, and institutional buyers.

Power Dynamics: Massively scaled entities—Sysco (17% market share), US Foods (10% market share), and Performance Food Group (8% market share)—dominate this segment. Their leverage derives from their ability to aggregate “Less-than-Truckload” (LTL) shipments into full, economically efficient freight loads, reducing per-unit transportation costs through sophisticated route optimization.

Structural Role: The Regional Distribution Center (RDC) represents the operational nerve center of this segment. These facilities consolidate products from diverse suppliers, enabling a single delivery truck to provide everything a commercial kitchen or grocery store requires. This consolidation capability creates significant value for both suppliers (reduced shipping complexity) and buyers (simplified procurement with single-source ordering).

Core Functions:

-

- Product consolidation maximizing transportation efficiency and reducing total logistics costs

- Inventory buffering through strategic “safety stock” positioning that protects the system from demand volatility and supply disruptions

- Value-added services including product customization, specialized packaging, and merchandising support

5. Retail & Foodservice: The Consumer Gatekeepers

The final node represents where consumers interact with the supply chain. This “last-mile” segment serves as the ultimate point of data collection through point-of-sale systems that capture real-time demand signals.

Power Dynamics: Retail giants like Walmart and regional powerhouses like H-E-B exercise significant market power as the final gatekeepers to consumer access. Their leverage manifests through shelf-space control and the strategic expansion of private label programs, which enable retailers to compete directly with the branded manufacturers who supply them. Private label products now represent over 24% of total grocery sales, with some retailers like H-E-B achieving 34% private brand penetration.

Structural Role: Retail has evolved into an omnichannel operational environment. Physical store locations now function simultaneously as traditional retail spaces and micro-fulfillment centers for e-commerce orders. Demand planning at this stage—informed by real-time sales data and predictive analytics—dictates procurement patterns that cascade upstream through the entire supply chain.

Core Functions:

-

- Merchandising strategies governing product presentation, shelf positioning, and stock rotation protocols that manage perishability

- Micro-fulfillment operations utilizing back-of-store space for picking, packing, and shipping online orders

- Data analytics platforms that convert point-of-sale information into actionable demand forecasts

Back in the day, the chain was more fragmented and filled with price fluctuations and supply disruptions. Nowadays the power resides in the physical infrastructure—the regional distribution centers, the processing facilities, and the cold storage networks—that maintains the continuous flow of value from agricultural production to consumer purchase. Understanding these five nodes, each with distinct economic characteristics and competitive dynamics, is key to seeing where leverage exists, how market power is exercised, and why certain disruptions cascade through the system while others remain contained.